vestr – Schedule a call

Let's optimise your workflow.

To help us connect you with the right sales team member or resource, please fill out the form.

Capture new revenue from custody and execution fees by offering innovative, structured investment solutions tailored to EAMs and wealth clients.

Use AMCs to launch custom strategies that combine traditional assets like equities and bonds with non-traditional holdings such as private equity, debt, or real estate, all in a single, tradable wrapper

Drive growth in Assets Under Custody and unlock cross-selling opportunities across FX, execution, lending, and structured solutions.

Become a strategic partner by enabling fully customized product structuring, supporting EAMs, family offices, and internal wealth channels with flexible, client-centric solutions.

AMCs let your asset management team bring strategies to market quickly and efficiently, including thematic ideas (e.g. ESG, innovation), tactical asset allocations, or alternative exposures, while retaining control over IP and economics.

Actively Managed Certificates (AMCs) are structured products issued as debt securities, which enable Strategy Managers to pool investors in a single trading account and execute their tailored strategy.

AMCs can dynamically invest across equities, bonds, commodities, alternatives, and even private or digital assets. They allow active portfolio adjustments via intraday rebalancing, empowering managers to adapt quickly to market shifts.

Issuers can structure and launch AMCs within weeks, avoiding lengthy registration processes and high setup and ongoing costs.

Onboarding of the investor via their bank

AMCs can be listed or OTC-traded with ISINs, offering intraday access, real-time pricing, and easy transfer across accounts like equities or bonds.

With vestr’s AMC platform, you benefit from full transparency and reporting. Investors can receive daily disclosures of holdings and NAV, giving near‑real-time insight into portfolio composition and performance, far exceeding the periodic updates typical of passive funds.

Enables efficient onboarding and flexibility using pre-connected issuing vehicles in Ireland and Luxembourg.

Tell us your preference: your own execution desk, a third-party prime broker, or a custodian.

Offer your clients a branded portal for portfolio management and investment reporting.

Asset managers can quickly launch new products using your services and infrastructure.

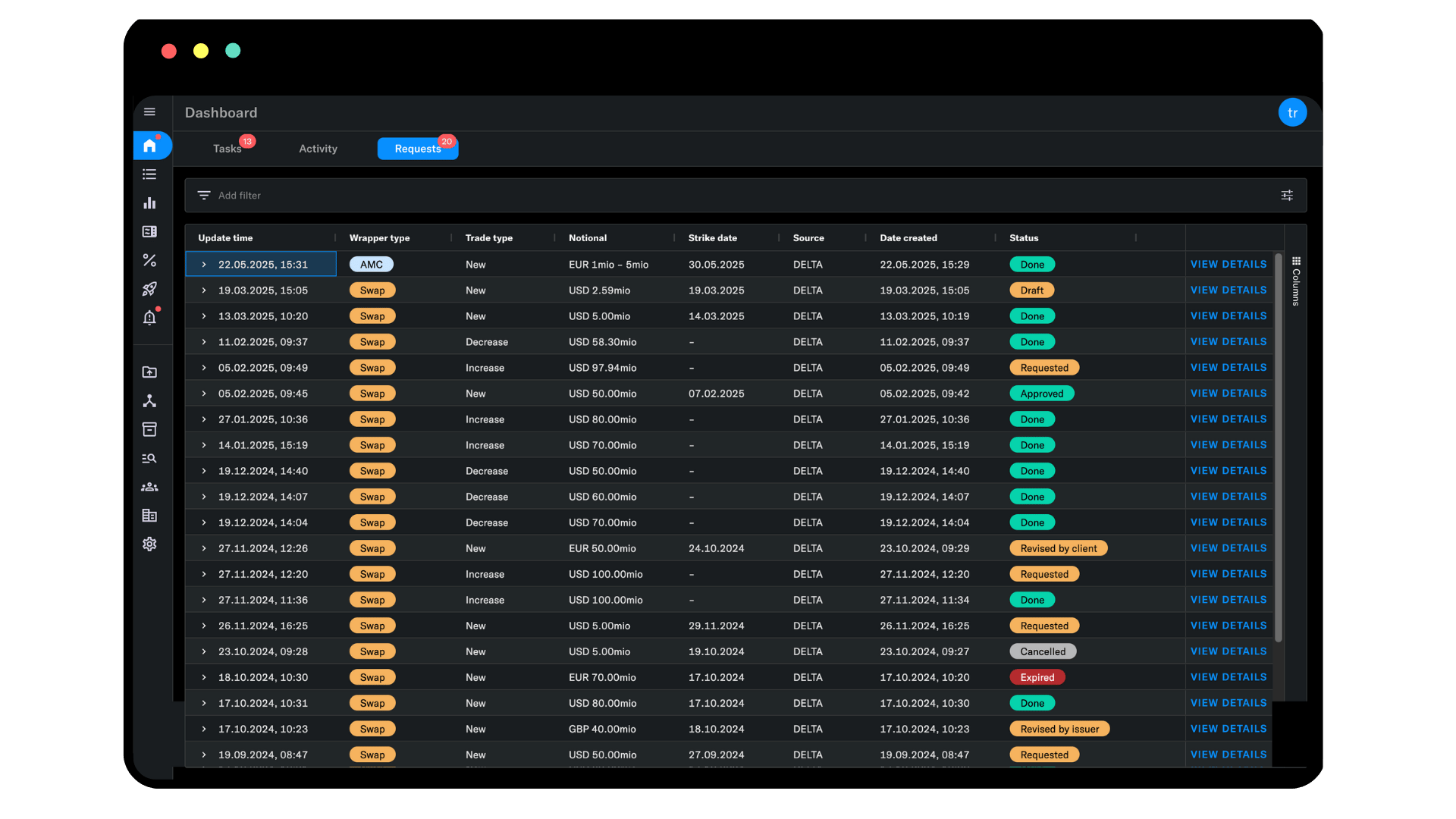

Get a complete view of your product’s lifecycle, including its composition, key documents, recent activity, update timelines, and detailed tracking of all changes and events.

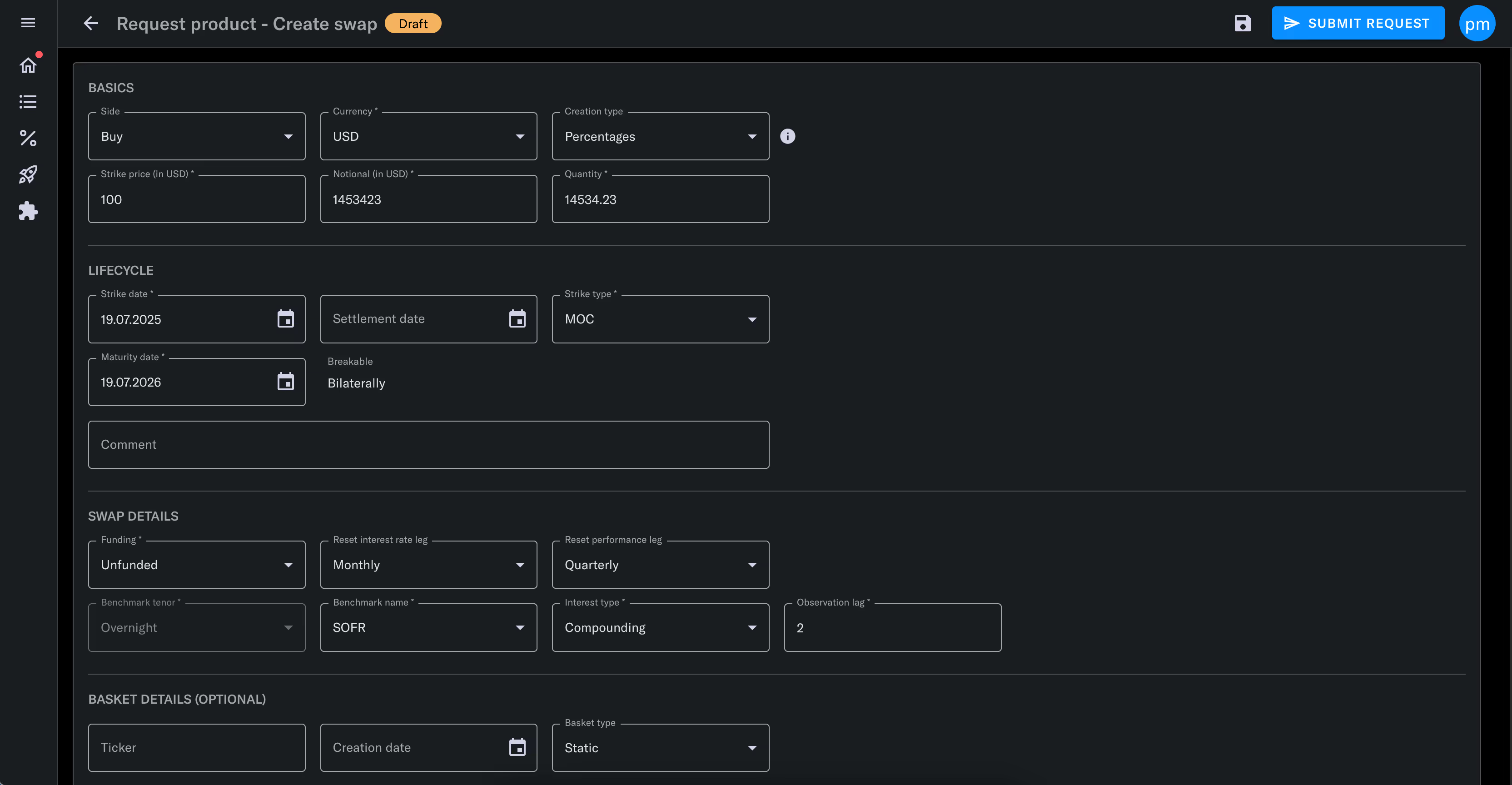

Manage your portfolio with tools for entering and importing orders, adjusting target portfolios, and reinvesting cash. Keep track of all changes with a detailed audit trail, ensure compliance with pre- and post-trade checks, and handle specifics like FX hedging and cut-off times.

We support any underlying asset and asset class.

Create detailed and customizable reports in multiple languages, complete with live previews and user-specific templates. Add your own branding with custom logos, colors, and layouts, and include charts, tables, and key product details. Download reports as PDFs, subscribe via email, or generate versions for past dates.

Maintain full oversight and control with features like 4-eye checks, pre- and post-trade validations, and global short restrictions. Define custom product constraints, such as allow/block lists, weight and exposure limits, and rebalancing rules. Every action is tracked in a detailed audit trail for complete transparency.

Easily manage and track fees with detailed history, charts, and filters, plus export options. Handle various fee types, including tiered management fees, performance fees with hurdle rates, tailored fees with flexible structures, and custody or transaction fees by asset class.

Monitor and compute NAVs with precision through daily calculations, automated and manual confirmations, and tools for coherence checks and deviation thresholds. Stay informed with alerts for missing NAVs and support for various NAV frequencies. Publish daily NAVs to exchanges like VSE and SIX, and manage snapshots with import options and automated midnight captures.

Easily integrate with your systems using file imports for products, trades, rebalancings, and other data. Automate imports via SFTP, connect through our GraphQL API, or use FIX 4.2+ for trading. Compatible with downstream systems like FA, Sophis, and Avaloq.

Work with trusted third-party services for key data and operations. Access reference data from Bloomberg, EDI, and Solactive, ESG data from Clarity AI, and calculations through Solactive. Brokers and custodians include Interactive Brokers and Crypto Finance, with live prices from Interactive Brokers, Xignite for FX, and TTMZero.

Customize the platform to match your brand with options for your own URL, landing pages, logos, colors, and chart styles. Add custom fields, tabs, and pages to fit your specific needs while ensuring a consistent experience for both internal and external users.